BIBO - Bounded-Input-Bounded-Output is an engineering term. It comes from Control Systems Theory and signifies that any system, to be stable, must respond to a bounded input with an equally bounded output.

Our system of bank currency - the money we are using every day - has a fatal design flaw - it violates the BIBO principle. Economic instability is built in to our money right from the start. This leads to the imperative that the economy must keep expanding endlessly. We are unable to achieve sustainable economic activity, to preserve our planet's finite resources, lest we face financial collapse.

This, in short, is the situation as argued by Marc Gauvin and Sergio Dominguez of bibocurrency.org

A formal stability analysis from the standpoint of control systems theory has shown that the mechanism of interest inherent in money creation and in everyday lending practices must lead to monetary instability (inflation) and eventually to the collapse of economic activity. Adding interest to the principal of any loan to be repaid creates an excess debt that, within the confines of the economic system, can never be fully paid off, resulting in an inherently unstable economic situation.

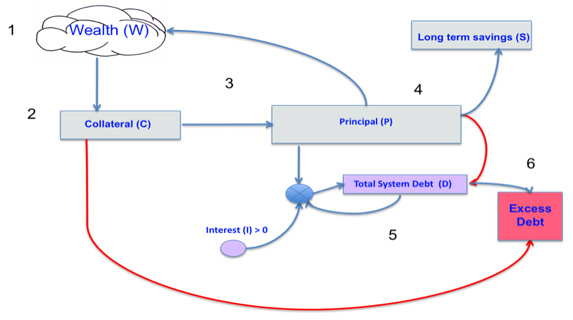

Financial System walkthrough

1. Wealth is generated by ingenuity, human effort and resources made available through past investment of units of currency.

2. Through the process of asset evaluation, a fixed amount of existing wealth is attributed a fixed collateral value in the form of a sum of units of currency.

3. The fixed collateral sum is used as the basis for the creation of new currency in the form of a second fixed value i.e. the principal sum of loans issued into circulation through current account entries. Since both the collateral and principal loan sums are fixed, they maintain a constant ratio to the wealth pledged.

4. Current account units are distributed back to wealth producers through purchasing transactions or may be saved or stored (at a compounding interest rate) or used to cancel debt thus reducing the total amount of money in circulation.

5. Total debt due is the principal sum entered as a negative number in a loan account to which interest is added such that the debt grows as a function of time.

6. Because the total debt created always exceeds the amount of money available to satisfy it, the system produces a minimum residual debt that must be refinanced in subsequent cycles thus compounding it.

No comments:

Post a Comment